Should we invest in mutual funds through SIP or Lumpsum, and there has been always a question that which is better SIP Vs Lumpsum Investment. Where will we get more returns? Usually, people believe that SIP always gets better returns. We will analyze the data of mutual fund returns.

Why Invest in Mutual Funds?

The first question is why should we invest in mutual funds? We can invest in FD as well. It is a fact that and you must be aware that, we get more returns than FD in mutual funds. If we talk about the long term. But when we talk about more returns, we are comparing with FD. We want to see the investment strategy in mutual funds where we get more returns.

The next question is SIP Vs Lumpsum Investment Which is Better In Mutual Fund? Where one should invest and where one would get more returns. First, we have to understand SIP and lumpsum and their advantages.

What’s A Systematic Investment Plan (SIP)?

If we talk about SIP, its full form is a systematic investment plan. What is SIP? This means that you can transfer a fixed amount of the money that comes from your salary every month to the mutual fund. This payment can also be done automatically by applying an automatic mandate.

What Are the Advantages Of SIP?

A Systematic Invest Plan (SIP) comes with various advantages and some of which are discussed below:

- The First advantage of SIP is that it becomes a discipline people often tend to save and invest money every month automatically.

- The Second advantage of SIP is that whenever we invest in SIP, let’s say the markets are falling. When we invest in mutual funds, we are investing in the stock market.

if the markets are falling, our cost is averaging. Let’s say if you invested in a mutual fund, its NAV was 100. After some time, its NAV was 90, then 80, then 70. You invested something in every amount. The average NAV can be 70. Accordingly, our cost is averaged.

But if the cost is averaged, then our returns are also averaged. Because our buying price has been averaged out. So, we are not getting the advantage that when the market is falling, let’s say the NAV is 60, we didn’t invest at that time. Because of this, our cost and returns are averaged You don’t have to worry too much.

- The Third advantage of SIP is that we don’t always need to track the stock market. If our cost is averaging, then every month our money is being invested. So, we don’t need to track what is going on in the market. So, this is a very good way to do passive investing.

What is Lumpsum Investment?

Now, let’s talk about lump sum investing. Whenever we get some cash and we invest it at one go, we call it lump sum investing.

For example, if we get a performance-linked incentive or a bonus from our company, we can invest it in the form of lump sum investing in mutual funds. We can invest our matured FD If we get a gift from parents or friends, we can invest it in the form of a lump sum.

We can invest it in the form of a property sale. But the question arises that is why should we invest in the form of a lump sum? Why Lumpsum Investment? Is there any advantage to it?

Advantages Of Lumpsum Investment

Lumpsum Investment comes with various advantages and some of which are discussed below:

- The First advantage of lumpsum investment is that first of all, if you invest that money in FD or in your savings account, then you won’t get much returns.

So, if we want gains on this lump sum amount, if we want to multiply that money, then obviously we should invest it. So, one obvious advantage is that we have the opportunity to spend our money on it.

- The second big advantage of lumpsum investment is better returns with the right entry. Understand this carefully. As we had discussed in the case of SIP, if our NAV is 100 and the market is slowly falling to 60, then are we getting a lot of profit? If we invest it at the level of 60, then we won’t get much profit.

SIP vs Lumpsum Investment Real Life Example

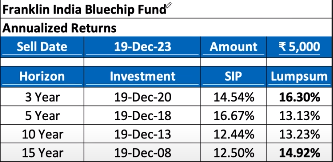

Let’s take a real life example by analyzing Franklin India Bluechip Fund and we will try to analyse its 3 year, 5 year, 10 year, and 15 year returns from that we will see were we get the return in both SIP and Lumpsum investment

And wherever more returns came, why did they come? It is very important for us to analyze this data.

How Returns Are Calculated?

If we had taken the exit from this fund on 19 December 2023, if we had sold it, that means if we had invested in it 3 years ago, on 19 December 2020, then how much returns would have been made in our SIP? 14.54% returns would have been made.

Here SIP means, let’s say, if we had invested Rs.5000 every month, then how much returns would we get? and this is Compounded Annual Growth Rate (CAGR) also known as annualized returns. In the form of lumpsum, how much returns would we get?

That means if we had invested lump sum money, if we had invested 50,000 lump sum on 19 December 2020, even if we had invested Rs. 5000, the amount doesn’t matter.

But the percentage returns that would have been made, would have been 16.3% returns. As said earlier that in SIP usually people think that more returns are received. Here, more returns are being received in lump sum.

- And let’s analyze more data if we look at the 5-year returns, then in SIP, 16.67% returns in lump sum, 13.13% returns. Here, the SIP returns have increased.

- Now if we look at the 10-year data, then the SIP returns are coming out 12.44% and the lump sum returns are coming out 13.23%. Although the lump sum returns are a little more but still there isn’t any significant difference.

- If we look at the 15-year returns, then here the SIP returns are coming out 12.5% and the lump sum returns are coming out 14.92%. Now look, when the difference of 2-2.5% returns is coming out, then this can matter a lot in our long term.

Because this can make a lot of difference in our overall corpus. So that’s why it is very important for us to analyze.