If you are a beginner then choosing the best mutual fund company and investing in mutual funds can be very challenging because of such complicated processes. Because in 2024 there are tons of mutual fund companies where the problem lies in choosing the best mutual fund company to invest in.

Since there are various types of mutual funds choosing the best mutual fund is challenging therefore in this beginner’s guide, you will see how to choose the best mutual fund company. and how to invest in mutual funds.

How To Choose The Best Mutual Fund Company?

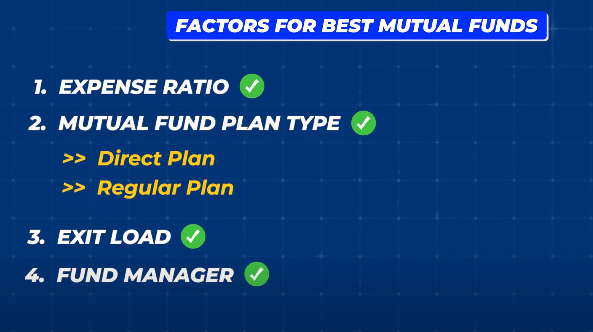

Now suppose 4 companies are offering large-cap funds, then we also have to know which company’s fund is right for you. So which company’s mutual fund is best depends on 4 Factors:

- Expense Ratio

- The Right Mutual Fund

- Exit Load

- Fund Manager

Expense Ratio

The first is the Expense Ratio. Now because mutual funds are managed by professionals, then the knowledge, experience, and skills that they are applying for you, for that you have to give them a percentage which we call Expense Ratio. You can see this from 0.1% to 2.25%.

Generally, the expense ratio of less than 1.5% is considered right. This means if you are investing Rs.1000 and the expense ratio of any mutual fund is 1%, then you will invest Rs.990 there and the expense will be Rs.10, which is quite nominal.

The Right Mutual Fund

Now the second factor you have to take care of is that every mutual fund is of 2 types:

- Direct Plan

- Regular Plan

There is no third party in the Direct Plan. So here your money is directly invested in the mutual fund. Whereas in the Regular Plan, there is some third party like Broker, Advisor, or Distributor. So when you buy through them, then it is called a Regular Plan.

In Direct Plan, the expense ratio is also less because there is no third party in between whom you have to give commission. Whereas in the Regular Plan, there is a third party. So here the expense ratio is high. And because the expense ratio in the Direct Plan is less, then you generally get high returns.

Whereas in the Regular Plan, the expense ratio is high. So you generally get a little less returns. So it is recommended that one should always invest in the Direct Plan.

Exit Load

Now the third factor you take care of is Exit Load. Whenever you invest in a mutual fund, there is a time cap. You should not withdraw money from the mutual fund for as long as the time period.

But if you still want to withdraw your money in that time period, then you have to pay some charges here which are called Exit Load.

A lot of people don’t pay attention to this first. And after that, when they need money in an emergency and they withdraw their mutual fund, then they have to pay good charges. So first of all, whenever you are investing in a mutual fund, then do it for the long term and don’t withdraw it before the time.

But if you are not sure, then always invest in such a mutual fund whose exit load is very low.

Fund Manager

And the fourth factor that you should take care of is the Fund Manager. Like driving any car, its driver is the main factor and it depends on the driver how well the car will run and how long it will run. Similarly, the driver of every mutual fund is its fund manager.

Now this fund manager invests your money on the basis of his knowledge, experience, and skills so that you get the best returns. So the more knowledge and experience the fund manager has, the better the fund will be. So always look at the fund manager’s experience and skills.

To know more about the fund manager, you can check the past performance of the funds managed by them. This will give you an idea about the fund manager’s skills. So before buying any mutual fund, you should definitely check all these things.

How To Invest In Mutual Funds?

So now you have understood what a mutual fund is and how you can select the best mutual fund. You have also understood this. So now you know that if you want to invest in a mutual fund, then how can you do that?

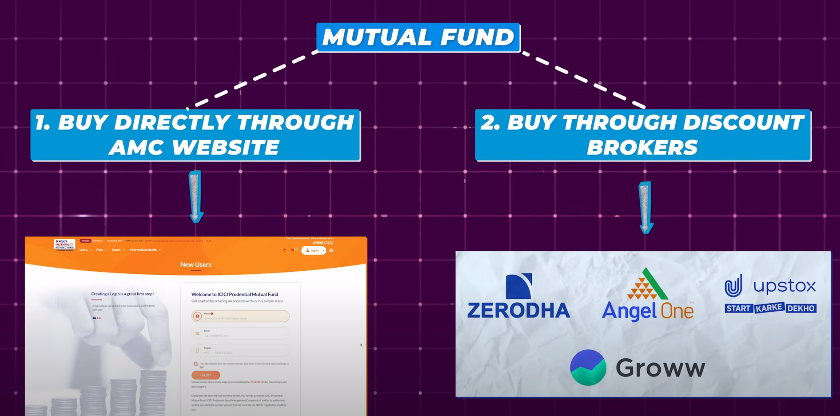

So see, there are two ways to invest in a mutual fund. The first way is to buy it directly from the website of the mutual fund you want to buy.

The second way is to buy it through a Demat account like Angel One, Zerodha, or Upper Stocks.

It is recommended that, if you buy through a Demat account, it will be better because you will be able to see the performance of your stocks and mutual funds at the same place.

Opening A Demat Account Through Angel One

So if you have a Demat account, you can invest from there. Now suppose if you want to buy a mutual fund through Angel One, then for this, firstly open your Demat account in Angel One, after a day or two, you will get your login ID and password, after which you can go to the Play Store or App Store and download the Angel One app and sign in to it.

- After signing in, as soon as you go to the mutual fund option, you will see the option for mutual funds. Click on it.

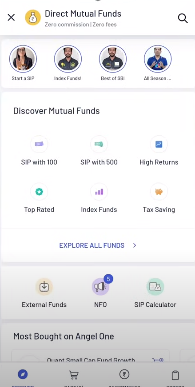

- As soon as you click on it, you will see a lot of types of mutual funds. For example, if you want to invest in an index fund, you have to click on it. And here you are getting to see a lot of types of mutual funds.

- So here you will get to see You can click on them and invest in them. For example, if you want to invest in ICICI Prudential Blue Chip Fund Direct Plan Growth, You have to click on it. As soon as you click on it, you will get a lot of information about it.

For example, its expense ratio is 1.04%. Apart from this, you can also see the size of this fund. You can also see the exit load. You will also get all the other information here. If you want to invest in it, you have to click on Invest.

If you want to do SIP, that is, you want to invest every month, Or if you want to do a one-time investment, you can select it from here. You can start your investment by clicking on Start SIP.